All Categories

Featured

Table of Contents

You can obtain against the cash money value of your policy for things like tuition repayments, emergencies and also to supplement your retirement revenue (Term life). Bear in mind, this still is thought about a financing, and if it's not paid off before you pass away, after that your death advantage is lowered by the amount of the car loan plus any kind of superior passion

Basically, a biker is utilized to tailor your plan to fit your demands. As an example, if you're terminally ill, a sped up survivor benefit rider may pay out a portion of your survivor benefit while you're still alive. You might utilize the payout for points like medical costs, to name a few usages, and when you pass away, your beneficiaries will certainly get a decreased life insurance advantage given that you made use of a portion of the plan currently.

This information represents only a short summary of protections, is not component of your policy, and is not a promise or guarantee of protection.

Insurance coverage policy terms and conditions may use. Exclusions might use to plans, recommendations, or bikers. Policy Forms: ICC17-225 WL, Policy Type L-225 (ND) WL, Policy Form L-225 WL, Policy FormICC17-225 WL, Policy Form L-226 (ND) WL, Policy Kind L-226 WL, Policy Kind ICC17-227 WL, Policy Kind L-227 (ND) WL, Plan Kind L-227 WL, ICC21 L141 MS 01 22, L141 ND 02 22, L141 SD 02 22.

How can I secure Universal Life Insurance quickly?

Normally, there are numerous kinds of life insurance coverage alternatives to take into consideration: term life insurance, whole life insurance policy, and global life insurance coverage. Fatality benefits are normally paid in a swelling amount payment. This cash can cover costs like medical bills, end-of-life prices, outstanding debts, mortgage settlements, medical insurance, and tuition. A minimum of three in four American grownups showed they own some type of life insurance policy; however, females (22%) are twice as most likely as males (11%) to not have any life insurance policy.

This could leave less money to pay for expenses. Each time when your loved ones are currently dealing with your loss, life insurance policy can aid relieve a few of the financial worries they might experience from lost income after your death and help give a monetary safeguard. Whether you have a 9-to-5 task, are freelance, or have a small company, your existing income could cover a part or every one of your family members's daily requirements.

44% reacted that it would take less than six months to experience monetary difficulty if the key wage income earner passed away. 2 If you were to die unexpectedly, your other relative would certainly still need to cover these ongoing household expenditures also without your revenue. The life insurance policy survivor benefit can aid change earnings and ensure monetary stability for your enjoyed ones after you are no longer there to offer for them.

What should I know before getting Final Expense?

As an example, funeral services can be pricey. Handling this financial anxiety can include to the psychological strain your household might experience. Your family can use several of the fatality benefit from your life insurance plan to help pay for these funeral service costs. The policy's beneficiary can guide several of the survivor benefit to the funeral chapel for last expenses, or they can pay out-of-pocket and use the survivor benefit as compensation for these costs.

The ordinary cost of a funeral service with funeral is nearly $8,000, and for a funeral with cremation, it's approximately $7,000. The "Human Life Value" (HLV) principle concerns life insurance policy and financial preparation. It represents a person's value in regards to their economic contribution to their household or dependents. To put it simply, if that individual were to drop dead, the HLV would certainly approximate the economic loss that their family members would incur.

Senior Protection

Eighth, life insurance policy can be made use of as an estate planning device, assisting to cover any type of required estate taxes and last expenditures - Trust planning. Ninth, life insurance coverage plans can offer certain tax obligation benefits, like a tax-free death benefit and tax-deferred cash money value build-up. Life insurance policy can be a crucial component of shielding the financial safety of your liked ones

Talk with among our monetary specialists concerning life insurance policy today. They can help you examine your demands and discover the best policy for you. Interest is charged on loans, they may generate an income tax liability, decrease the Account Worth and the Survivor Benefit, and may create the plan to lapse.

Retirement Security

The Federal Federal government developed the Federal Personnel' Group Life Insurance Policy (FEGLI) Program on August 29, 1954. It is the largest team life insurance policy program in the globe, covering over 4 million Federal employees and senior citizens, along with a lot of their family participants. The majority of employees are qualified for FEGLI insurance coverage.

It does not construct up any money worth or paid-up value. It contains Standard life insurance policy protection and 3 alternatives. In most instances, if you are a new Federal worker, you are automatically covered by Fundamental life insurance and your pay-roll office deducts costs from your income unless you waive the coverage.

You need to have Fundamental insurance coverage in order to choose any of the options. Unlike Standard, registration in Optional insurance is not automated-- you must take action to elect the options.

How do I get Universal Life Insurance?

You pay the complete price of Optional insurance policy, and the cost depends on your age. The Office of Federal Personnel' Team Life Insurance Coverage (OFEGLI), which is a personal entity that has a contract with the Federal Government, processes and pays claims under the FEGLI Program.

Possibilities are you may not have adequate life insurance coverage for yourself or your enjoyed ones. Life occasions, such as getting married, having youngsters and buying a home, may create you to require more defense.

You will certainly pay the exact same monthly premium despite the variety of youngsters covered. A kid can be covered by just one parent under this Strategy. You can sign up in Optional Life insurance policy and Reliant Life-Spouse insurance throughout: Your initial enrollment; Open up enrollment in October; orA special qualification circumstance. You can enroll in Reliant Life-Child insurance coverage during: Your preliminary enrollment; orAnytime throughout the year.

Think of your age, your financial scenario, and if you have people that depend upon your earnings. If you choose to buy life insurance coverage, there are some things to consider. You might want to think about life insurance policy if others rely on your revenue. A life insurance policy plan, whether it's a term life or whole life plan, is your individual residential or commercial property.

How do I apply for Family Protection?

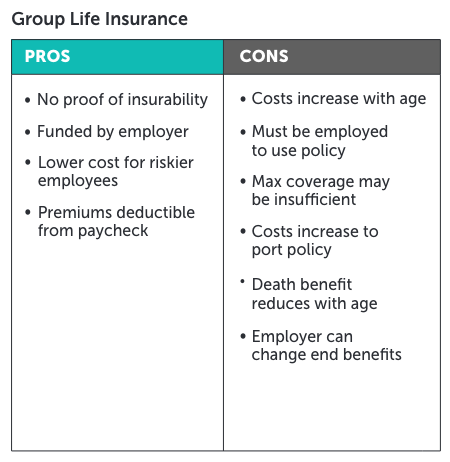

Here are a number of cons of life insurance policy: One downside of life insurance policy is that the older you are, the extra you'll spend for a policy. This is due to the fact that you're more probable to die throughout the plan period than a more youthful insurance holder and will, in turn, set you back the life insurance business even more cash.

Latest Posts

Instant Quotes Life Insurance

New York Life Final Expense Insurance

Instant Life Insurance