All Categories

Featured

Table of Contents

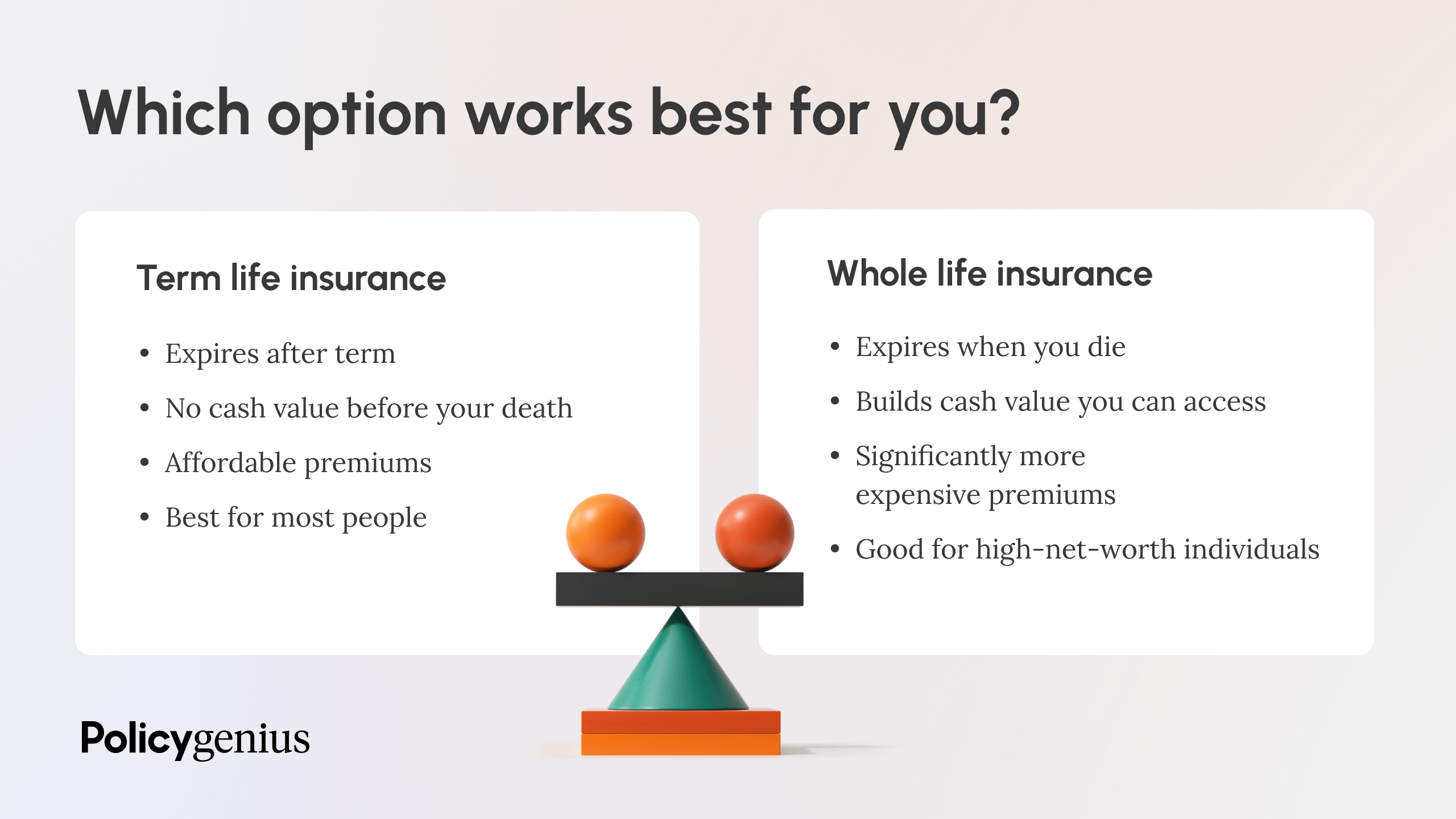

Degree term life insurance policy is one of the most affordable insurance coverage choices on the marketplace due to the fact that it offers fundamental defense in the kind of survivor benefit and only lasts for a collection time period. At the end of the term, it ends. Entire life insurance, on the other hand, is significantly extra expensive than level term life because it does not run out and features a cash value attribute.

Rates may vary by insurer, term, protection amount, wellness class, and state. Level term is a wonderful life insurance alternative for the majority of people, however depending on your coverage needs and personal situation, it might not be the best fit for you.

How long does Level Term Life Insurance For Families coverage last?

This can be a good option if you, for instance, have just stop smoking and need to wait 2 or three years to use for a level term plan and be qualified for a reduced rate.

, your death benefit payout will certainly decrease over time, yet your repayments will stay the same. On the various other hand, you'll pay even more ahead of time for much less coverage with an increasing term life policy than with a level term life plan. If you're not certain which kind of plan is best for you, working with an independent broker can help.

Who offers Level Term Life Insurance Quotes?

Once you have actually made a decision that level term is best for you, the next step is to buy your policy. Here's how to do it. Compute how much life insurance policy you need Your insurance coverage quantity ought to offer your family members's lasting monetary demands, including the loss of your earnings in the event of your fatality, along with financial debts and everyday expenses.

As you look for methods to protect your economic future, you have actually most likely come throughout a wide range of life insurance policy alternatives. Picking the best insurance coverage is a big decision. You intend to discover something that will certainly assist sustain your enjoyed ones or the reasons crucial to you if something occurs to you.

Numerous individuals lean toward term life insurance coverage for its simpleness and cost-effectiveness. Level term insurance, nevertheless, is a type of term life insurance policy that has regular settlements and a constant.

How do I choose the right Level Term Life Insurance Benefits?

Degree term life insurance policy is a part of It's called "degree" since your premiums and the benefit to be paid to your loved ones continue to be the very same throughout the contract. You will not see any changes in price or be left wondering about its value. Some contracts, such as yearly eco-friendly term, might be structured with costs that increase gradually as the insured ages.

Repaired fatality benefit. This is additionally set at the start, so you can recognize specifically what fatality advantage amount your can expect when you pass away, as long as you're covered and current on premiums.

How do I compare Level Death Benefit Term Life Insurance plans?

You concur to a set costs and death benefit for the period of the term. If you pass away while covered, your fatality advantage will certainly be paid out to enjoyed ones (as long as your premiums are up to date).

You might have the choice to for one more term or, more probable, renew it year to year. If your contract has actually a guaranteed renewability clause, you might not require to have a new medical examination to keep your insurance coverage going. Your costs are most likely to enhance because they'll be based on your age at renewal time.

With this option, you can that will last the remainder of your life. In this instance, again, you might not need to have any brand-new medical examinations, but premiums likely will increase due to your age and new insurance coverage. Various companies offer various choices for conversion, be sure to recognize your choices before taking this step.

A lot of term life insurance is level term for the period of the contract period, yet not all. With reducing term life insurance, your fatality benefit goes down over time (this kind is often taken out to specifically cover a long-term financial obligation you're paying off).

Level Term Life Insurance Calculator

And if you're established for eco-friendly term life, after that your premium likely will go up yearly. If you're exploring term life insurance policy and intend to make sure uncomplicated and foreseeable monetary protection for your family, degree term might be something to think about. As with any type of type of protection, it might have some limitations that don't fulfill your needs.

Generally, term life insurance is a lot more budget-friendly than long-term insurance coverage, so it's an economical method to protect monetary protection. Adaptability. At the end of your agreement's term, you have numerous alternatives to proceed or proceed from insurance coverage, commonly without requiring a medical examination. If your spending plan or coverage needs change, survivor benefit can be minimized in time and lead to a reduced costs.

Where can I find Level Term Life Insurance Policy Options?

As with other kinds of term life insurance policy, as soon as the agreement ends, you'll likely pay higher premiums for protection due to the fact that it will recalculate at your present age and health. Level term offers predictability.

However that doesn't suggest it's a suitable for everybody. As you're purchasing life insurance coverage, below are a couple of essential factors to take into consideration: Budget plan. Among the benefits of degree term insurance coverage is you understand the expense and the survivor benefit upfront, making it less complicated to without bothering with rises over time.

Generally, with life insurance policy, the healthier and more youthful you are, the more economical the protection. Your dependents and economic duty play a function in determining your insurance coverage. If you have a young family members, for instance, level term can help provide financial assistance throughout critical years without paying for coverage longer than required.

Latest Posts

Instant Quotes Life Insurance

New York Life Final Expense Insurance

Instant Life Insurance